AI Agent For Loan and Mortgage Applications Processing

Automatic document classification, key data extraction, data validation across multiple sources.

AI system development

3 AI developers

Mortgage lenders and brokers

Risk management and audit service providers

Challenge

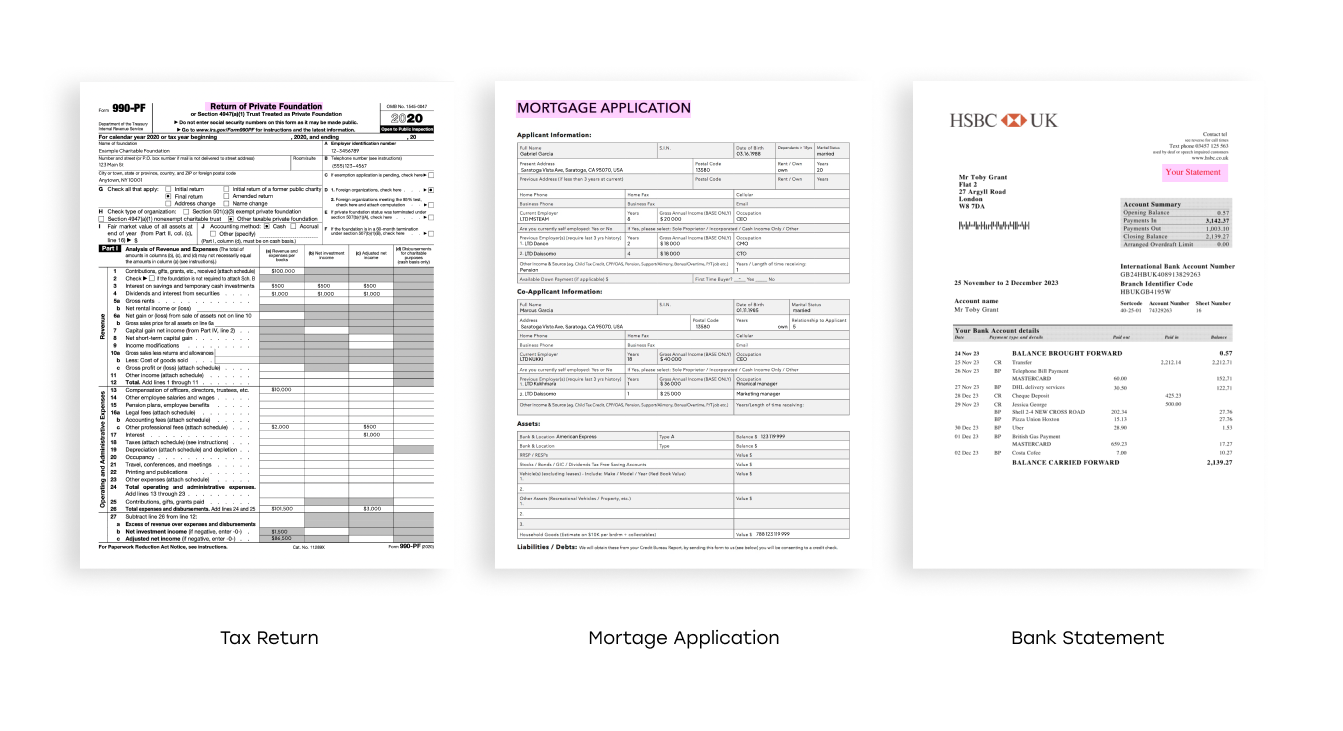

Our client, a large financial services provider, was looking to optimize their loan and mortgage application process. Each application included dozens of supporting documents — bank statements, pay slips, tax returns, ID documents, and property appraisals — all requiring manual review.

Processing a single application took up to a week and involved large back-office teams, leading to high operational costs and frequent human errors. At the same time, strict compliance requirements such as GDPR demanded secure handling of personally identifiable information (PII).

The client approached us to create an AI-powered document processing system that would automate data extraction, validation, and compliance checks while maintaining high accuracy and data security standards.

Solution

We developed an intelligent document processing (IDP) pipeline designed specifically for loan and mortgage applications. The system automatically classifies documents, extracts key data, and validates it across multiple sources.

Document Classification

The system automatically detects document types (bank statements, tax returns, or property appraisals) using a combination of OCR and machine learning models.

Data Extraction and Validation

Azure Document Intelligence is used for OCR and structured data extraction. Extracted data such as income, tax liabilities, and property valuation is processed with fine-tuned GPT models for contextual understanding.

The system performs cross-validation between data points — for example, matching declared income from the application form against tax returns and pay slips.

Contextual Analysis

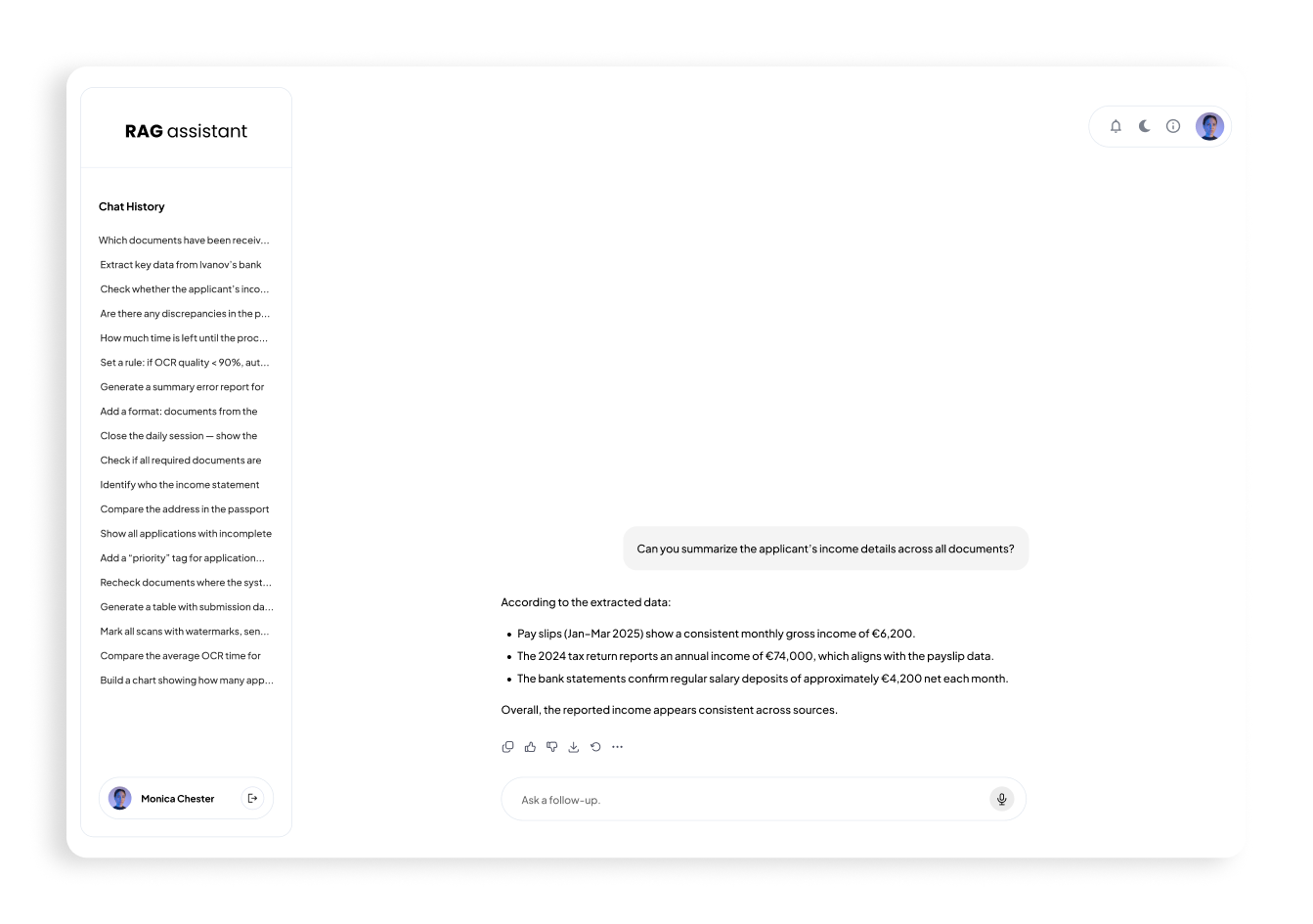

A Retrieval-Augmented Generation (RAG) assistant helps underwriters analyze extracted data, highlight inconsistencies, and explain potential discrepancies, speeding up decision-making while keeping experts in control.

Adaptability to Document Variety

Mortgage applications often include documents of different formats and layouts. The system uses few-shot prompting to adapt to new document types without retraining.

Low-quality Document Handling

Integrated OCR preprocessing improves image clarity and text readability in scanned or low-quality documents. When confidence falls below a threshold, the document is automatically flagged for manual review.

.png)

Security and Compliance

All processing is performed within a secure Azure environment. Data is encrypted at rest and in transit, with PII redaction, role-based access control, and detailed audit logging to ensure compliance with GDPR and regional banking standards.

Technical Implementation

- Azure Document Intelligence for OCR and structured data extraction.

- GPT-based LLMs (GPT-4o, Gemini 2.5 Pro) with RAG pipelines for contextual reasoning.

- PostgreSQL + encryption for secure structured data storage.

- Azure Key Vault & RBAC for access control and compliance.

- LangChain orchestration for pipeline automation and modular processing.

Results

The AI-driven document processing system significantly improved the efficiency and accuracy of loan and mortgage application handling:

- Processing time reduced by 70%, from 5–7 days to under 48 hours.

- Error rate decreased by 60%, ensuring higher accuracy and fewer manual corrections.

- Operational costs cut by 40% through automation of document review and validation.

- Improved customer experience, as applicants received loan decisions much faster.

- Scalable architecture, easily extended to new document types and regional compliance frameworks.

Success Stories

Contact Us

Let's Work Together!

Do you want to know the total cost of development and realization of the project? Tell us about your requirements, our specialists will contact you as soon as possible.